IRS 8879 2021-2026 free printable template

Instructions and Help about IRS 8879

How to edit IRS 8879

How to fill out IRS 8879

Latest updates to IRS 8879

All You Need to Know About IRS 8879

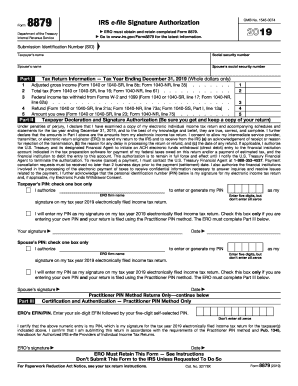

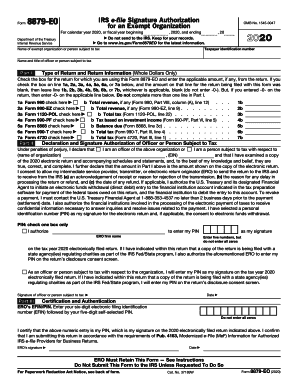

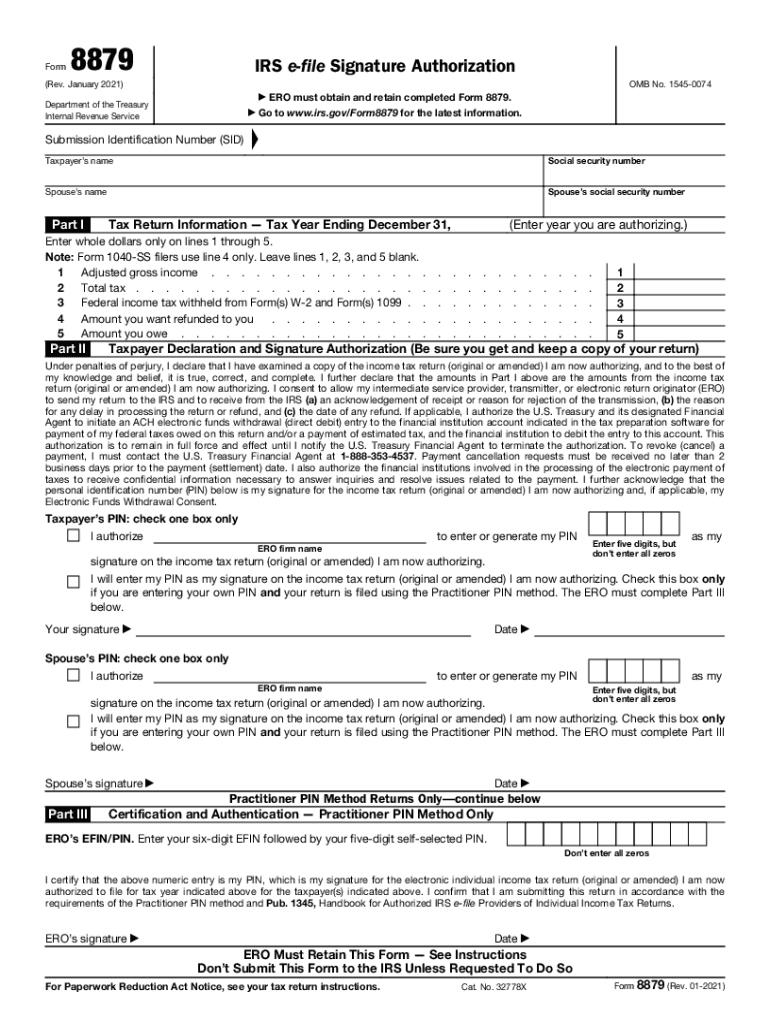

What is IRS 8879?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

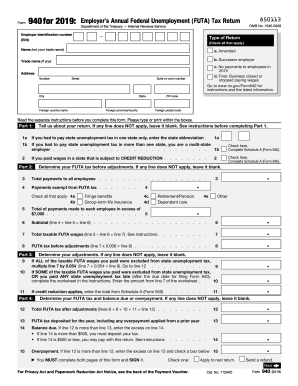

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8879

What should I do if I realize I made a mistake after submitting IRS 8879?

If you find an error after submitting your IRS 8879, you should file an amended return as soon as possible. This entails correcting the information on your e-file and resubmitting a new IRS 8879 along with the updated tax return. Ensure that you indicate that it’s an amended submission to prevent confusion.

How can I track the status of my IRS 8879 submission?

To track the status of your IRS 8879 submission, you can check the e-filing status through the tax software you used. Additionally, you may receive confirmation from the IRS once they've processed your form. It's common to encounter rejection codes; knowing these can help you troubleshoot issues quickly.

What should I consider regarding e-signature acceptability when using IRS 8879?

When using IRS 8879, it's important to ensure that both the taxpayer and the preparer agree to the e-signature process. The IRS accepts electronic signatures on this form, but you should familiarize yourself with specific security protocols and consenting methods to ensure compliance.

What common errors should I be aware of when filing IRS 8879?

Common errors when submitting IRS 8879 include incorrect taxpayer identification numbers and issues with electronic signatures. Double-check all entered information and follow the required e-signature procedures. Taking the time to ensure accuracy can save you from potential processing delays.

See what our users say